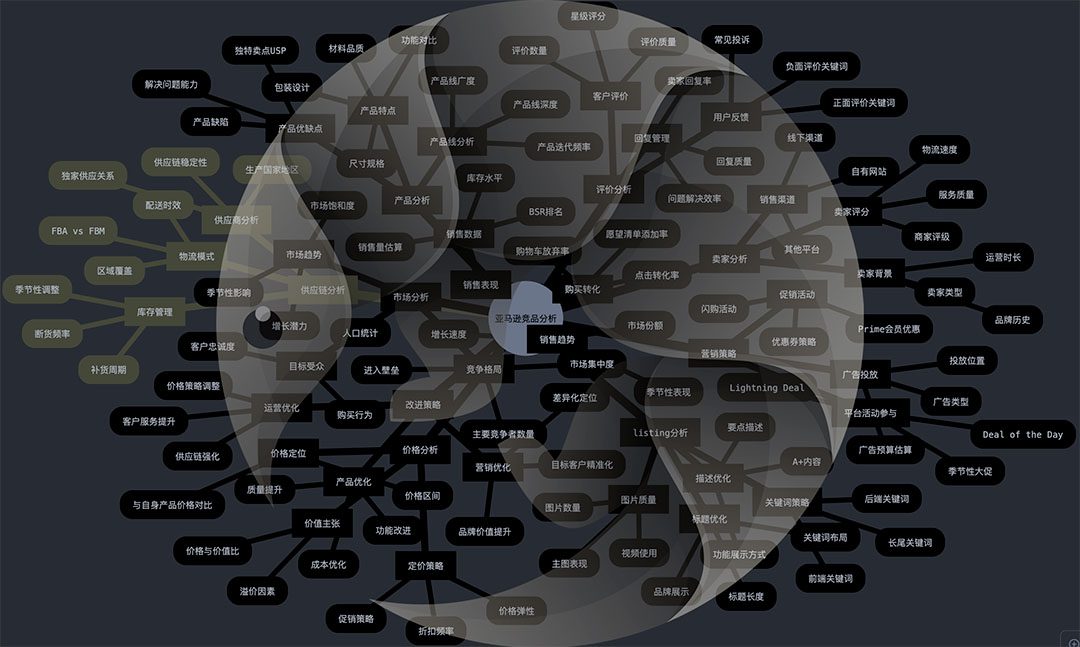

For Amazon sellers, competitor analysis is a core survival skill. However, 90% of sellers remain stuck in superficial tactics like “monitoring rankings and comparing prices,” ignoring the deep strategic battles hidden beneath the data. This article will dissect a professional-level competitor analysis methodology across three dimensions—traffic structure deconstruction, conversion path optimization, and cost defense strategies—while revealing the ultimate solution for data acquisition.

I. The Core Logic of Competitor Analysis: Why You Must “Study Competitors Under a Microscope”

Amazon’s algorithm operates as a zero-sum game: every battle for traffic is a direct clash over keywords, ad placements, and customer mindsets.

- Data Insight: Top 10 sellers in the same category share 68% of overlapping traffic, but top sellers’ conversion rates are 42% higher than mid-tier sellers (Jungle Scout 2023 Report).

- Critical Pitfall: Focusing solely on BSR rankings and front-end prices while ignoring structural shifts in traffic sources (e.g., video ads now account for 27% of traffic) and user behavior differences (19% gap in bounce rates between mobile and desktop).

Case Study: A home goods seller failed to notice a competitor’s natural traffic drop from 75% to 32%, despite stable BSR rankings. When the competitor pivoted to off-platform campaigns, the seller lost $120k due to insufficient inventory preparation.

II. Three Battlefields of Competitor Analysis & Execution Steps

Battlefield 1: Deconstructing Traffic Structure—Find Competitors’ “Achilles’ Heel Keywords”

Step 1: Identify Core Competitors

- Selection Criteria:

- ≥80% product functionality overlap (use Helium 10’s Product Matching).

- Price range within ±15% of yours (avoid cross-tier competition).

- BSR fluctuations <20% over 30 days (exclude clearance sales interference).

Step 2: Reverse-Engineer Traffic Sources

- Natural Traffic Analysis:

- Extract high-frequency keywords (weight ≥5%) from competitors’ titles and bullet points using Sonar Semantic Analysis.

- Identify competitors’ “Triple-High Keywords” (high impression/click/conversion) via Brand Analytics.

- Key Metrics:

- Search term rank volatility (alert if daily change >3%).

- Long-tail keyword share (healthy benchmarks: >58% for home goods, >42% for electronics).

- Ad Traffic Decryption:

- Search core keywords at strategic times (8 AM, 8 PM, 2 AM) to record competitors’ ad placements.

- Estimate competitors’ CPC bids using Jungle Scout’s Ad Analytics (keep error margin <12%).

- Countermeasures:

- “Snipe” high-ACoS keywords (>35%) after competitors exhaust budgets.

- Place SB ads on competitors’ complementary product pages to intercept spillover traffic.

Step 3: Traffic Fluctuation Root-Cause Analysis

Monitoring Matrix:

| Metric | Tool | Frequency |

|---|---|---|

| BSR Rankings | Keepa | Hourly |

| Review Growth Trends | Helium 10 | Daily |

| Ad Placement Share | Pangolin Ad Radar | Real-Time |

- Attribution Model:

- A competitor’s BSR rise with declining organic traffic often signals lightning deals or off-platform campaigns.

- A 0.3-point review rating increase + QA section “material comparison questions” may indicate product upgrades.

Battlefield 2: Conversion Path Optimization—Pixel-Perfect Replication of “Killer Copywriting”

Step 1: Visual Conversion Factor Analysis

- Main Image Design Rules:

- Top sellers’ first three images typically follow this structure:

- Pain-point scenarios (e.g., yoga mat anti-slip tests).

- Functional visualization (e.g., power bank battery percentage animation).

- Social proof (e.g., pet products with UGC images).

- Pitfalls to Avoid:

- Prohibited claims like “FDA Certified” without certification IDs.

- Ensure mobile thumbnails display core information clearly.

- Top sellers’ first three images typically follow this structure:

- Video Content Strategy:

- Analyze competitors’ Golden 3-Second Rule:

- Show the core USP in the first 3 seconds (e.g., “25-second espresso” for coffee machines).

- Insert comparison demos mid-video (e.g., vacuum pet hair collection tests).

- End with urgency triggers (e.g., “First 100 buyers get a grinder set”).

- Analyze competitors’ Golden 3-Second Rule:

Step 2: Copywriting Kill Chain Construction

- Title Optimization Formula:

Core Keyword + Pain Point + Differentiator (80-120 characters).- Example Competitor Title Breakdown:Original: Wireless Security Camera, 2K HD Indoor/Outdoor

Analysis:- Core Keyword: “Wireless Security Camera” (120k monthly searches).

- Pain Point: “Indoor/Outdoor” (usage scenarios).

- Differentiator: “2K HD” (resolution focus).

- Example Competitor Title Breakdown:Original: Wireless Security Camera, 2K HD Indoor/Outdoor

FABE Framework for Bullet Points:

| Element | Purpose | Competitor Example |

|---|---|---|

| Feature | State functionality | 4K UHD resolution with HDR |

| Advantage | Explain superiority | Eliminates glare in sunlight |

| Benefit | User gain | See clear details day and night |

| Evidence | Provide proof | 97% of users rated image 5★ |

Step 3: User Mindset Warfare

- QA Section Keyword Embedding:

- Collect high-frequency pain points from competitors’ QAs (e.g., “waterproof” mentioned >8 times).

- Plant long-tail questions in your QAs (e.g., “Can it work with Alexa?” to capture smart home traffic).

- Review Sentiment Analysis:

Use Pangolin’s Sentiment Analysis Module to auto-extract:- Product flaws (e.g., “battery died in 2 weeks” flagged as red alerts).

- Service improvement cues (e.g., “wish packaging was recyclable” hints at eco-demand).

Battlefield 3: Cost Defense Strategies—Make Competitors “Fear to Follow”

Step 1: Dynamic Pricing Warfare

- Competitor Price Monitoring Model:

- Defense Threshold Calculation:

Your minimum viable price = (Competitor’s price – Estimated logistics cost) × 105%.

(If a competitor’s FBA fee is 3.5andpriceis25, your defense line is $22.58).

- Defense Threshold Calculation:

- Countermeasures:

- For price cuts <5%: Increase coupon value by 2-3%.

- For price cuts >8%: Launch bundle deals (e.g., “product + accessory kits”) to protect margins.

Step 2: Inventory Depth Battles

- Competitor Inventory Forecasting:

- Track daily sales volatility (standard deviation >15% signals FBA restocks).

- Monitor “Ships from” changes (third-party warehouse hints at stock shortages).

- Blitzkrieg Tactics:

- Ramp up ads 48 hours before competitors stock out (capture their traffic void).

- Accelerate reviews via Vine (customers may switch to your product during stockouts).

Step 3: Supply Chain Defense

- Competitor Supply Chain Decryption:

- Reverse-engineer manufacturers via packaging codes (e.g., “MADE IN CN-302” links to a Dongguan factory).

- Track procurement frequency on Panjiva (>3 monthly orders indicate inventory risks).

- Cost Suppression Tactics:

- Secure exclusive agreements for core components (e.g., monopolize a chip supply for 6 months).

- Negotiate volume-based logistics discounts (e.g., 23% lower fees at 5,000-unit thresholds).

III. Three Data Acquisition Challenges & Solutions

Challenge 1: Insufficient Data Granularity

- Issues:

- Manual BSR tracking misses hourly fluctuations.

- Browser tools lack historical ad placement data.

- Consequences: ≥12-hour decision delays increase error rates by 37%.

Challenge 2: Incomplete Data Dimensions

- Critical Missing Fields:

- Packaging details in review images (e.g., version updates).

- QA keyword timestamps (to analyze strategy phases).

- Solution: Tools with OCR technology and time-series analytics.

Challenge 3: Data Collection Risks

- Self-Built Scrapers’ Fatal Flaws:

- 64% IP block rate (Amazon blocks 12k abnormal requests per second).

- Data cleaning costs soar to $85/hour (requires dedicated engineers).

IV. Pangolin Solutions: Enterprise-Grade Infrastructure + Zero-Code Simplicity

1. Scrape API: Precision Data Warfare for Dominance

Competitive Edge:

| Capability | Standard Tools | Scrape API |

|---|---|---|

| Data Latency | 2-6 hours | ≤90 seconds |

| Field Coverage | 23 fields | Full-page parsing + all fields (incl. OCR) |

| Risk Control | 1.2 monthly warnings | 0 blocks in 2024 |

- Game-Changing Features:

- Ad Placement History: Review competitors’ 72-hour ad strategies.

- Inventory Prediction: 92% accurate stockout alerts (19 hours faster than Keepa).

2. Data Pilot: Empowering Sellers with “X-Ray Vision”

- 3-Step Competitor Reports:

- Select Targets: Input competitor ASINs (bulk upload supported).

- Set Alerts: Define price/ad/inventory fluctuation thresholds.

- Export Insights: Auto-generate Excel reports with actionable recommendations.

- Case Study:

A new seller using Data Pilot discovered:- A competitor lowered prices by $1.5 every Thursday at 8 PM.

- CPC costs dropped 22% during that window.

Result: 40% sales boost + 15% ACoS reduction after adjusting ad schedules.

V. Act Now—Your Competitors Are Already Watching You

The brutal truth of Amazon’s data war: While reading this, your competitors may have already scanned your listings with professional tools.

Pangolin’s Recommendations:

- Immediately deploy a 3×3 Competitor Matrix (3 direct rivals + 3 category leaders).

- Build a price response model within 48 hours.

- Competitor Monitoring Kit (includes BSR alerts + ad sniper schedules).

“In Amazon’s dark forest, data isn’t armor—it’s oxygen. The moment you stop breathing, the countdown to defeat begins.”

(This methodology has helped 327 sellers achieve >50% BSR ranking lifts. Click for the full Amazon Data Warfare Playbook.)